Is The Federal Medicaid Spend in Jeopardy?

After the narrow decision of the 119th House of Representatives to pass the Continuing Resolution H.CON.RES.14 with a vote of 217-215 in the waning hours of Tuesday, February 25th there is a shockwave of media surrounding the boilerplate items listed within the legislation. Microscope has taken a deeper dive into the 60-page bill that has many in the healthcare industry searching for an answer to what comes next.

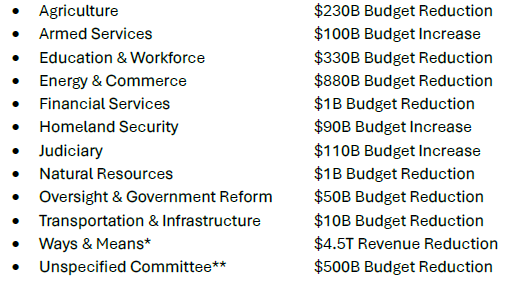

As Speaker of the House Mike Johnson initially indicated in an interview with The Hill on Tuesday morning: “Do a word search for yourself. It doesn’t even mention Medicaid in the bill, so that’s an important point.” Which may be true, however the bill itself covers the proposed budget cuts, and in some committees increases, to 11 different house committees in the Reconciliation section 2001 of the document. The proposed budget changes impact the following house committees:

In total the budget cuts to the 8 committees listed above are $2 Trillion alongside a $4.5 Trillion tax cut that would span across the next 10 years from 2025 – 2034 to the House Committee of Ways and Means.

Where the rubber meets the road for the healthcare industry is within the $880 Billion dollar budget reduction to the Committee of Energy & Commerce as that group in the House of Representatives also has jurisdiction over the Medicaid & Medicare programs. In the next 10 years the total Medicaid budget that the committee will oversee is just under $8.2 trillion dollars.

President Trump and Speaker of the House Mike Johnson have both pledged that Medicaid and Medicare budget cuts are not on the table for this committee. Although, when looking at the breakdown of the federal spend on Medicaid, Medicare and other Health & Non-Health related items for this $880B budget cut; it has become increasingly troublesome of where the cut is going to stem from. To understand where these budget cuts could come from there are multiple avenues the Committee may take to meet the legislation’s demands.

*It is important to highlight that the proposed Revenue Reduction to the Committee of Ways & Means is the chief tax-writing committee of the House of Representatives where a reduction in revenue is synonymous with tax code relief.

**Upon review of the reconciliation section 2001 of the bill it is notable that there is $500B in budget cuts that would be imposed on the other 10+ committees in the House of Representatives not mentioned in this section of the bill.

Cutting Health & Non-Health Spending

Even if the committee were to cut these budget items within the next 10 years the amount still required to cut would be close to $600B dollars. This committee also oversees the Children’s Health Insurance Program (CHIP) which data shows that children enrolled in this program reached levels of 9.65M during FY2018 & FY2019, and most recently as of October 2024 7.25M people were enrolled in CHIP. CHIP covers uninsured children up to the age of 19 in families with too much income to qualify for Medicaid and covers routine checkups, immunizations, prescriptions, dental & vision care, behavioral health and more. Cutting CHIP out of the budget has not been raised by any house representative or by the budget committee, however the option would save around

$200B dollars by eliminating the program.

Cutting Medicare Spend

An even more unpopular option would be to cut the larger portion of the committees spending by focusing on slashing Medicare. Republican constituents and President Trump have repeatedly stated that they will not target Medicare for budget cuts as that would go directly against what the Republican party campaigned on. This would also predominantly offset the gains the population over 65 have been making in the “no tax on Social Security” conversations being floated in D.C.

Cutting Medicaid Budget After All

The reason Washington is abuzz with talks of Medicaid Budget Cuts is because mathematically it is the most likely outcome of the passing of this continuing resolution. Coming from both sides of the aisle there is a confirmed mentality that the deficit needs to be addressed, but the sentiment of the Republican reconciliation is to look for fraud, waste, and abuse within the Medicaid program that would lead to overall savings. To say that the savings of fraud and waste found would average to $88B dollars a year from 2025-2034 is the intended pursuit of the Republican agenda.

On top of looking for fraud and waste there are multiple scenarios that would play out to saving tens and even hundreds of billions for the Medicaid spend.

Creating a National Work Requirement for Adults without a Disability or Children

Establishing this work requirement for Medicaid recipients would likely get many off Medicaid coverage in general and would save the program a projected $10B dollars a year over the lifetime of the proposed bill.

Reversal of the Biden-era Policy Limiting Recipient Eligibility Checks

The Biden administration lifted State requirements to impose eligibility checks on Medicaid recipients during the Covid-19 Pandemic where many who should not qualify may still be receiving Medicaid coverage. This reversal would save a projected $16B dollars a year over the lifetime of the proposed bill.

What Could this Mean for Healthcare Providers Moving Forward?

Healthcare Providers and regional hospitals rely on Medicaid funding and reimbursement as a lifeline for providing care to those that cannot afford private medical insurance. Cutting into the budget to the full extent of the $880B dollars could have a drastic impact on coverage for approximately 15.9 million Medicaid and CHIP enrollees in 2026 alone.

Healthcare Providers also receive Disproportionate Share Hospital (DSH) payments to qualifying hospitals that are payment comprised of both Federal and State funds, but the federal government dictates and limits the amount of funds available to each state. In FY2023 the Federal Medicaid DSH Allotment nationwide totaled $16B dollars with New York receiving the highest amount of DSH payments at just under $2.4B dollars. The rollback of federal funding would send ripples through Medicaid reimbursement rate setting, DSH allotment amounts at the federal level and DSH allotment amounts at the state level as those are determined by the Medicaid and Medicaid HMO population totals on hospital cost reports relative to a hospital’s nominal need and Uncompensated Care Costs.

As hospitals are still getting back online from the Covid-19 pandemic nearly 5 years since it shutdown the world as we knew it, many are continuing to face financial hardship due to a lacking workforce, long stays, and overwhelming emergency room volumes. Hospitals rely heavily on the reimbursement systems they have in place and on the support from both federal and state governments to provide coverage when patients cannot afford the private coverage options we face today. If the budget cuts hit Medicaid as many fear, there may also be a Medicaid rate rebasing soon to account for these rapid policy changes.

Despite the unknown and skepticism surrounding the legislation there is still a lot of time to see what will unfold and answers may come by the end of this month. Within the bill itself it calls for all the affected House Committees to present their action plans to the Committee on the Budget of the House of Representatives no later than March 27, 2025.

For more information, please contact: